Financial Reporting Council Now Rudderless, Sinking

Until that particular day in the first legislative session (1999 – 2003), federal lawmakers always stroll to their respective chambers in flowing Babaringa with broad smiles and banters. Despite the banana peels that swept off some members into irrelevance in the two chambers, the tumult of that era could not take away the shine and their happy moods.

A particular day was different. The atmosphere in the Federal House of Representatives was tensed and the mood of the members, stone-cold. Mobile telephone or GSM has just debuted and it assisted in networking outside the chambers to prepare for what was to happen at the plenary.

The lawmakers had been disturbed from the news filtering out from African Petroleum (Now Ardova) where some of them had invested a huge amount of money. Nigerians, the Federal Government and especially, the Bureau of Public Enterprises (BPE) had all just been scammed, and Sadiq Petroleum, the core investor that bought the federal government’s 30 percent hares in AP that was privatised in 2000 was not happy that debt as huge as N22.5 billion was not detected by the privatisation agency while preparing African Petroleum (AP) for sale.

Owing to the huge debt of AP, Sadiq Petroleum and other shareholders have on their hands a carcass. That was the first of the due diligence of the BPE that failed. The second was the one that heralded the sale of the Aluminum Smelter Company, (ALSCON) Ikot Abasi in Akwa Ibom State that ended in controversy and protracted litigation.

It was the same period that Cadbury Nigeria Plc also overstated its account and gave the shareholders a false sense of ownership.

The plenary at the House of Representatives on that day was different, the lawmakers were angry and they entrusted their House Committee on Commerce to detect how false financial reporting of Cadbury, AP, and that of the Lever Brothers; now Unilever (in the era of late Rufus Giwa) went undetected. Scrutiny of the various investment laws in the land as well as the relevant Federal Government agencies that were supposed to protect such laws began. The first to have a taste of the anger of the legislators was the Securities and Exchange Commission (SEC) which is the regulator for the capital market. The second was the Nigerian Stock Exchange (NSE) on which the three companies were listed.

After a heap of investigations, a tiny and obscure agency under the supervision of the Federal Ministry of Commerce (now Ministry of Industry, Trade, and Investment) as it was then called was found wanting and discovered to have been under-performing. Owing to the loopholes in the enabling law, that supposedly establish the agency, the cowboys that were behind the three entities could not be stopped from toying with people’s investments and lives.

That was the first time, the public knew of the quasi-parastatal of the Federal Government called the Nigerian Accounting Standard Board (NASB), the enormous and overwhelming responsibilities and usefulness the agency had (for the investing public) and also the fact that there was no adequate legal backing in its over 20 years of existence. Owing to its porous enabling laws, the tidal waves of the Nigerian investment space have turned it a paperweight which is tossed up and down and, in some cases, boxed.

With the support of and tireless works of Lanre Laoshe, a member of the House Committee on Finance and also, a member, of the House Committee on Commerce, in the first legislative session that ran from 1999 to 2003, the NASB was empowered with enabling legislation, the Nigerian Accounting Standards Board Act, No. 22, 2003 that gave it new and enormous powers to protect investors and make the economy safe for foreign direct investments to flow into Nigeria.

Just as Nigerians thought all is well and investments are safe, then the news came in from the United States of America that Enron has failed, taking away billions of dollars of investors’ money. Also came the news of the collapse of WorldCom, Parmalat, etc. which sunk with billions of dollars of investments. The failure of these companies threw global investors into confusion, fear, and depression which many could not live through.

This brought new fears to Nigerians and again, attention was turned to the NASB to see whether it could prevent the spillover from Nigeria.

The first fear that the NASB was behind time came on 4th November 2005, from the then Minister of Commerce, Idris Waziri, who raised an alarm that the NASB’s enabling law was not well-conceived and structured and as such, could not prevent the decline in the nation’s accounting system.

“I understand that the NASB had issued 21 accounting standards compared to over 40 issued by the International Accounting Standards Board (IASB), the world’s accounting standard-setting body. It is my hope that the Board (NASB) will work round the clock to bridge this gap,” Waziri said.

Noting that the nation’s accounting system, if well-structured and upgraded, will immensely pave way for more foreign direct investment and rid the nation of financial vices, Waziri stated that “a major objective of the Obasanjo led government’s reform agenda is the enthronement of transparency and accountability in all areas of our national life as a means of attracting the much-needed investment’.

Again on 22nd November 2006, Ibrahim Dankwambo (the then Accountant General of the Federation and former Governor of Gombe State) at the National Training Workshop on Accounting and Financial Reporting in the Public Sector in Abuja raised another fear.

“NASB is yet to issue any standard for use in the public sector” he noted as he lamented the lack of an established accounting standard for use in the public sector which continued despite all efforts to standardise accounting and financial reporting systems among the three tiers of government.

The complaints by both Waziri and Dankwambo and coupled with the collapse of both Enron and WorldCom set the tone for a fresh and total reform of the NASB. This new effort was again championed by Lanre Laoshe, who had exited the National Assembly in 2003, using his enormous legislative experience and influence to push through the new reforms of the NASB, which then metamorphosed into the current Financial Reporting Council of Nigeria (FRC) with powers strong enough to withstand several antics of many fraudsters in the Nigerian economic landscape.

Paperwork for the repeal of the Nigerian Accounting Standards Board Act No 22, 2003 began late 2009 after the exit of the then Executive Secretary of the NASB, Godson Nnadi, who exited office after 20 years, running the NASB as a quasi parastatal of the Federal Government until the NASB got the Act in 2003. In fact, he had to submit his resignation letter to the then Minister of Commerce and Industry, Jubril Martins Kuye, on 5th May 2010 as there was no justification for the continuation of his stay in that agency which was still obscure despite his methuselah tenure.

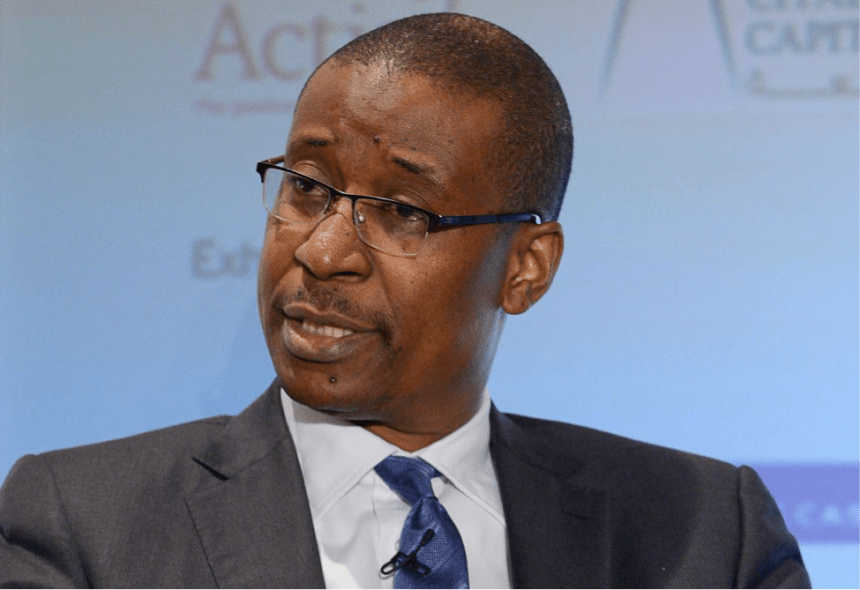

Then came the appointment of the fearless Jim Obazee in November 2010 by President Goodluck Jonathan.

That was the era of the global financial crisis during which the World Bank, was marketing reforms under its Economic Reforms and Governance Programme (ERGP) to world leaders including Nigeria. This global effort led to the urgency by the then Nigerian government to repeal the NASB Act 2003 and enact the Financial Reporting Council of Nigeria Act in June 2011. The Federal Government took this agenda seriously as they saw a huge window that will enable Nigeria to attract Foreign Direct Investments (FDIs) into the country which was then unattractive because of poor regulatory and governance framework. It actually paid off as Nigeria then rose to become the number one investment destination in Africa. This is a matter for another day.

The Council went to work and started with a roadmap for the phased adoption of the International Financial Reporting Standards (IFRS) which moved Nigerian firms and its managers to international financial reporting practices. This was an easy road for Jim Obazee because he was the one that chaired the National Committee for the Roadmap to the adoption of IFRS in Nigeria prior to his appointment as the Chief Executive Officer of the defunct NASB in November 2010. This phased transition provided for the introduction of financial reporting standards to allay the fears raised earlier by both Waziri, the former Commerce Minister, and Dankwambo, the former Accountant-General of the Federation.

Much of the work of the FRC was not in the limelight until the Goodluck Jonathan administration started to revamp the economy, and was working to up the ante for foreign direct investments which was very competitive among nations at the time and which still is though.

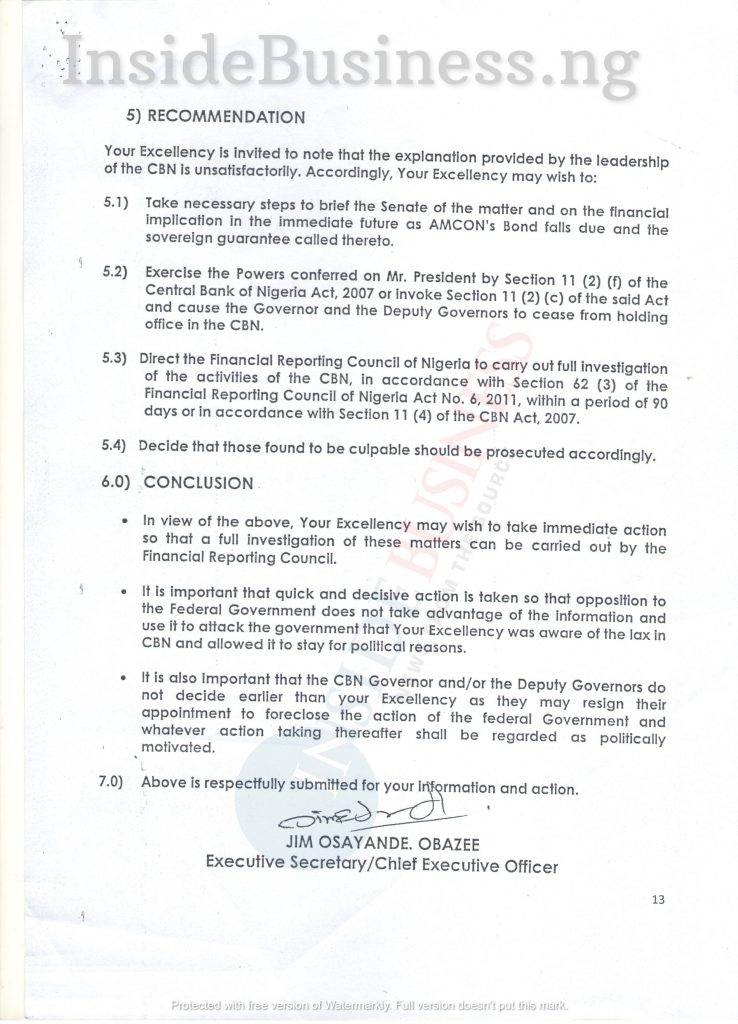

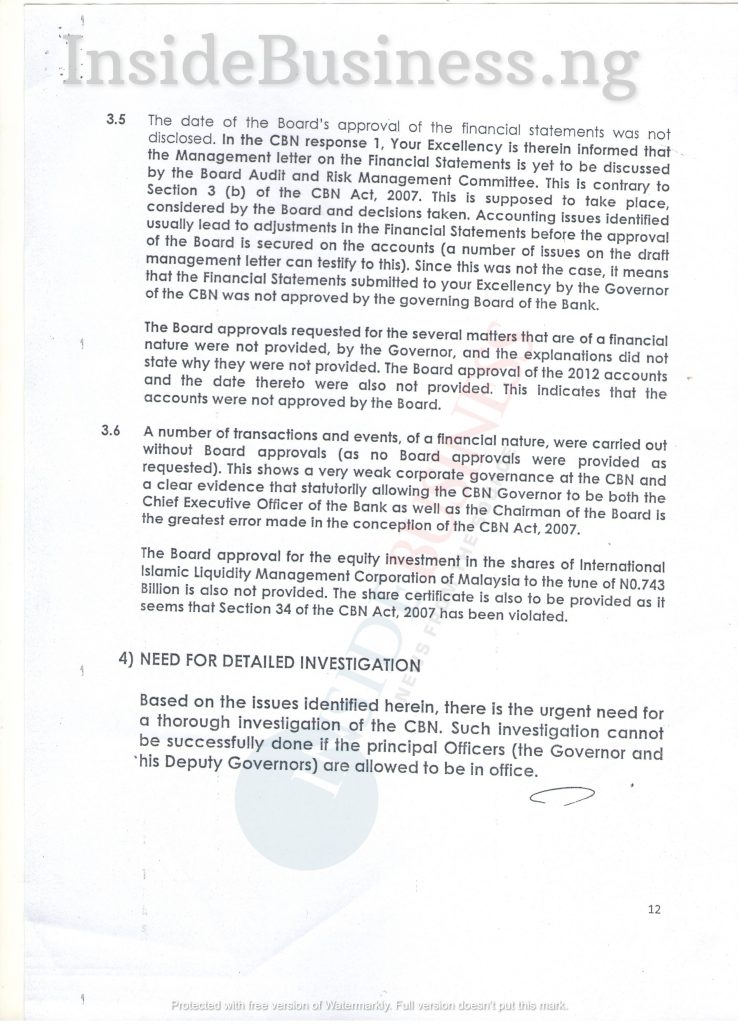

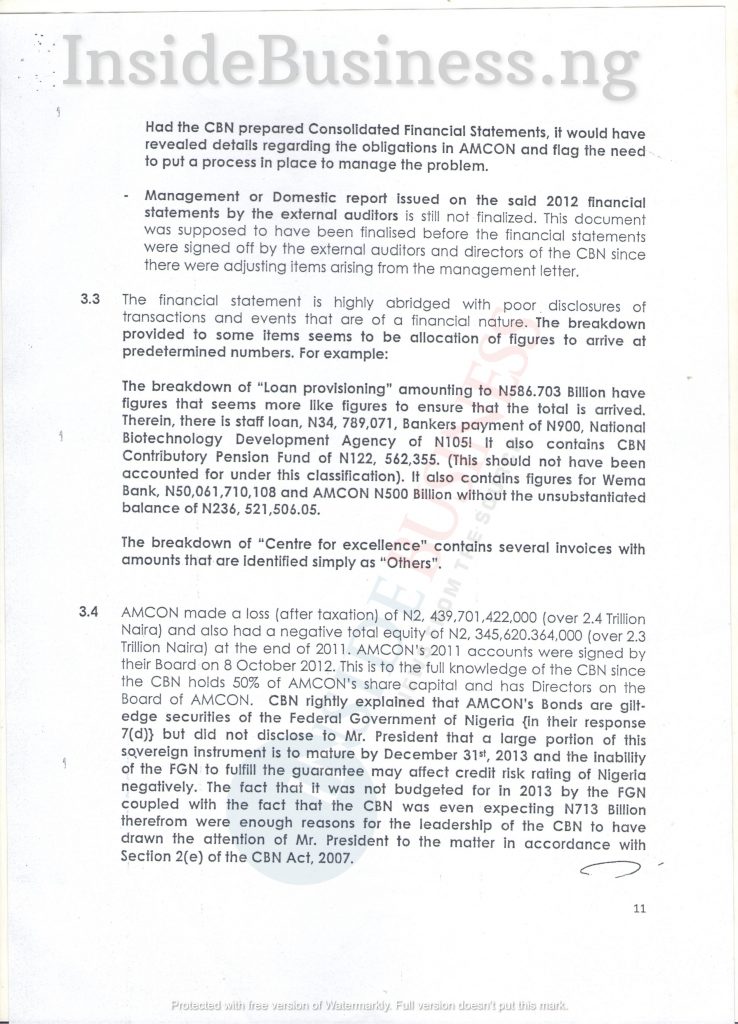

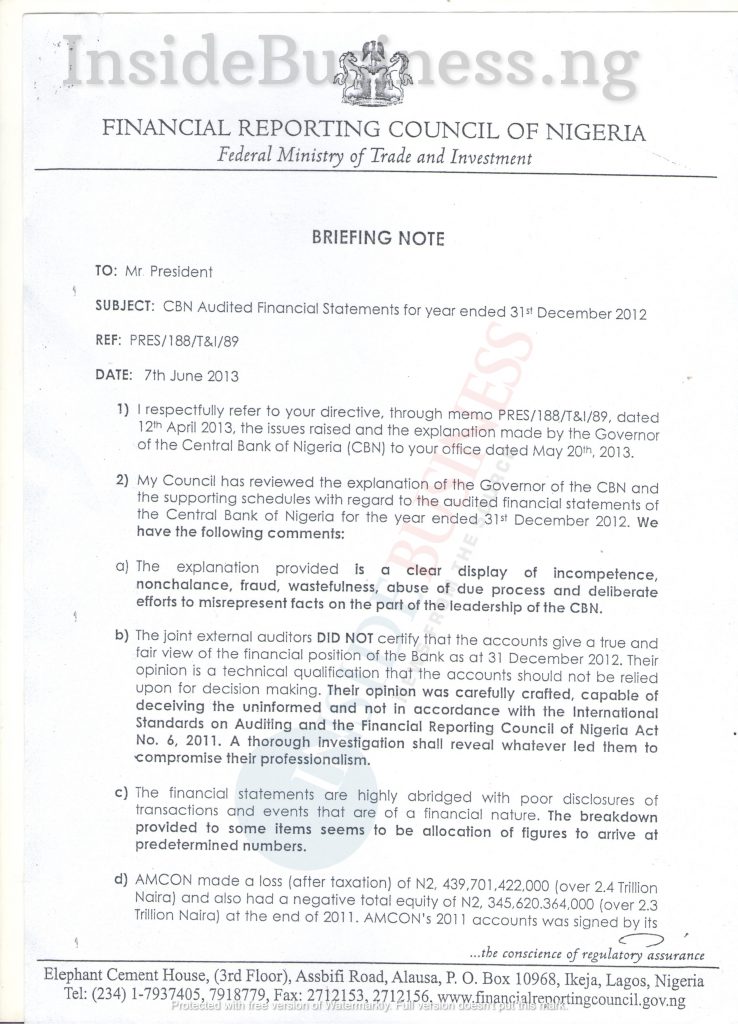

To demonstrate his administration’s readiness to make the Nigerian economy transparent, accountable, and give comfort to Nigerians and the global community, the Goodluck Jonathan led administration allowed the scrutiny of the accounts of government Ministries, Departments, and Agencies (MDAs) by the FRC. Even the “almighty” Central Bank of Nigeria (CBN) was not spared, of which the outcome led to the suspension and ultimate removal of its Governor, Sanusi Lamido Sanusi following the damning briefing note of the then CEO of FRC, Jim Obazee, to former President Goodluck Jonathan. This made an interesting and shocking read at the time and may still be worth our while as of today.

The FRC again bared its fangs on the private sector and Stanbic IBTC Bank was caught with several financial reporting infractions which led the FRC to direct the Bank to withdraw and restate its financial statements for two consecutive years in addition to a fine of N1 billion. StanbicIBTC Bank took FRC to court for redress but the judgment was given in favour of the Council. The External Auditor that signed the offensive financial statements of StanbicIBTC Bank, on behalf of KPMG, Ayo Othihiwa, was not spared by FRC which also suspended him from practice and withdrew his ability to sign any financial statements in Nigeria. KPMG also did not take this sanction lying low. The giant audit firm, like StanbicIBTC Bank, also took FRC to court. It also lost.

This led some observers to acknowledge that the fear of FRC is likened to the biblical injunction of searching for wisdom. The air of financial reporting sanity in Nigeria was evident to all. It was at this time that Nigeria was christened as the Number one investment destination in Africa. The FRC was not done yet. It then moved to reform the corporate governance codes in Nigeria which were largely persuasive and numerous. The FRC Act, 2011 domiciled the unification of these codes on the doorstep of the FRC as seen in sections 50 and 51 of the Act.

It is the issuance of this unified code of corporate governance by the FRC in 2016 that led to a series of events that opened the ground for the sinking of the FRC. Some persons and entities used the civilised path by taking the FRC to court. They, like StanbicIBTC Bank and KMPG, also lost to the FRC as the judges were satisfied that the FRC was following its enabling Act.

The so-called “prominent” Nigerians then decided to find a political solution by seeking the removal of the then Chief Executive Officer of the FRC, Jim Obazee, who they could not compromise under any guise.

On the faithful morning of January 9, 2017, the newspapers were awash with the news that Jim Obazee, the FRC czar, had been sacked by the President of Nigeria without reason other than that the General Overseer of a major Pentecostal Church in Nigeria whose followers included the Vice President, Yemi Osinbajo and the then Minister of Industry, Trade, and Investment (the supervisory ministry of the FRC) Okechukwu Enelamah, feels offended by some provisions of the Code of Corporate Governance for Not-for-Profit Organisations.

The announcement of the sack of the fearless Jim Obazee also came with the appointment of the current Executive Secretary of the FRC, Daniel Asakpokhai, and Adedotun Sulaiman as the chairman of the FRC governing board.

It is, however, interesting that the gentleman, that succeeded Jim Obazee at the regulatory body of financial statement reporting does not have a degree in Accounting other than the professional examination of the Institute of Chartered Accountants of Nigeria (ICAN). One needs not to consult the oracle to know that the grave of the FRC had just been dug by this misnomer because findings show that Asakpohia was at PricewaterhouseCoopers where he came from, a Risk Management Partner with no background in financial statement reporting.

The fraudulent minds celebrated the removal of the fearless Jim Obazee while Nigerians, who are the losers in this battle, watch helplessly.

Analysts criticised the appointment of the two individuals which they noted was wrong especially when the two were attached to companies that are under the regulation of the FRC. The entity from which the Executive Secretary was appointed from had a client that was in court with FRC (Eko Hotels wherein the auditors were also to be questioned because they were the signatory to the accounts) while Dotun Sulaiman that was appointed as chairman was a director in a company that was undergoing probe at the FRC over financial statement infractions and corporate governance abuses; at the time of the appointment.

Immediately after their appointments, the FRC began a steep decline from its lofty heights having lost its voice, and now, the foot-mat that is trampled on at will in the Nigerian economic space.

Some observers hold the view that the shameful drift of the FRC and the seeming recklessness of business owners and operators occasioned by the suspension of the National Code of Corporate Governance of 2016 and the nonchalant attitude of the FRC towards the promotion of credible financial reporting prompted Pastor Sunday Adelaja, a Nigerian-born clergyman in Kyiv, Ukraine to, on July 8, asked the Federal Government, in a global broadcast, to return Jim Obazee to clean up the country.

Adelaja caused a stir in the country, especially at Aso Villa, the Nigerian seat of power, with his sermon titled, “Buhari, Bring Back Jim Obazee to Clean religious circles in Nigeria”. Adelaja, the founder of the Embassy of Blessed Kingdom of God Church, who has huge followers in Europe, said the leadership and structure of the church in Nigeria are as guilty as the political class.

“We must bring back the former FRC boss to help us sanitise the public service and clean up religious circles in Nigeria”, Adelaja said in the sermon that ran on YouTube and drew huge followers and listeners.

The Nigerian born pastor said, “There are so many concepts that churches in Nigeria are promoting and some of the practices might be worse than what the politicians do”.

Adelaja’s request might have been informed by the inactiveness at the FRC under Daniel Asakpokhai, the current Executive Secretary whom, findings by InsideBusiness show that he has not been in the office since February this year.

A visit to the new office of the FRC on the Fourth and Fifth floors at Alexander House at Alausa Ikeja, Lagos, revealed that a Deputy Director, Iheanyi Anyahara, who also has no first degree in Accounting but has passed ICAN professional examinations, was in charge in an acting capacity for only three months between April to June. Currently, Anyahara’s tenure as Acting Executive Secretary has elapsed since the end of June and the FRC is now rudderless as the Executive Secretary is still out of the country and the governing Board is struggling to find a way out to manage the situation.

The staff of FRC, who volunteered information about the current situation of the organisation confirmed Pastor Adelaja’s fears. Since the exit of Jim Obazee, things have degenerated so fast that the FRC, will need to be cleansed before it can clean up the public space.

Efforts to get Anyahara to comment on the dwindling fortune of the FRC was not fruitful. Anyahara also, as a management staff, has helped in turning the Council to a boxing ring, bringing to the fore, the in-fighting among the staff. Iheanyi Anyahara and one Vincent Okhiria had exchanged blows in the presence of their juniors in the office. This was after the show of shame between Okediran Folashade and Nelson Anumaka.

Letter sent to Anyahara’s official email is yet to be answered but a hard copy of the letter was acknowledged by his office.

However, Anyahara in a WhatsApp message to InsideBusiness on June 22 said the Public service rules forbid him to comment without clearance from Asakpokhai, who unfortunately was not around.

“There is a substantive CEO. I am just holding the fort for him for a short period,” Anyahara said.

This current scenario at the FRC has now made it more compelling for President Muhammadu Buhari-led-Administration to quickly intervene in the Council and restructure its Board and management to enable the agency to deliver on its mandate.

Comments are closed.