Stocks Rise As House Passes Debt Deal

Stocks popped on Thursday after the House passed a bill to raise the debt ceiling late Wednesday evening.

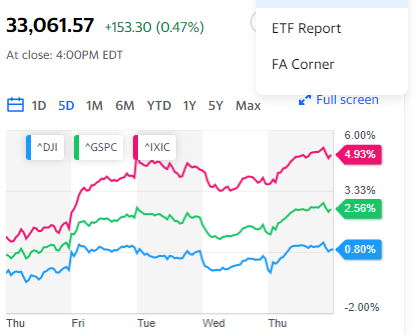

The S&P 500 (^GSPC) rose 0.99%, while the Dow Jones Industrial Average (^DJI) popped 0.47%, or 153 points. The technology-heavy Nasdaq Composite (^IXIC) was 1.28% higher.

A looming U.S. debt default, which Treasury Secretary Janet Yellen warned could come as soon as Monday, had begun to weigh on markets over the last week. But with the House passing the bill in a resounding 314-117 vote, investors will now ait action in the Senate.

“The deadline to raise the debt ceiling is rapidly approaching, and the likelihood of triggering a negative market reaction with severe economic consequences will only increase as we approach the precipice,” Business Roundtable CEO Joshua Bolten said in a statement after the House vote.

“We call on the Senate to eliminate the threat of a default by passing this bipartisan bill as soon as possible,” he added.

The artificial intelligence hype train that has been driving a rally in the Nasdaq since Nvidia’s (NVDA) blowout earnings report last week hit a speed bump after the close on Wednesday. C3.ai (AI) tumbled 13% on Thursday after the company reported weaker-than-expected full-year revenue guidance. The AI software developer expects revenue in a range of $295-$320 million. Wall Street had hoped for $321 million, per S&P Global Market Intelligence.

Shares of Salesforce (CRM) and CrowdStrike (CRWD) also stumbled. Salesforce fell 4.66% as investors harped on capital expenditure growth of 36% in the quarter. CrowdStrike stock slipped 1.6% losses as its full-year profit forecast came in at the low end of analyst expectations.

Meanwhile, retail earnings continued to provide a mixed picture of consumer spending. After the bell on Wednesday, Nordstrom (JWN) topped analyst expectations propelling shares up 4.77% during Thursday’s trading session. But on Thursday morning, Macy’s (M) cast a different tone. The retailer’s stock rose 1.2% despite lowering its full-year sales and earnings-per-share guidance.

“We planned the year assuming that the economic health of the consumer would be challenged, but starting in late March, demand trends weakened further in our discretionary categories,” Macy’s chairman and CEO Jeff Gennette said in the company’s earnings release.

Comments are closed.