Nestle Nigeria, Nigerian Breweries, Cadbury Nigeria In N145.06bn Loss

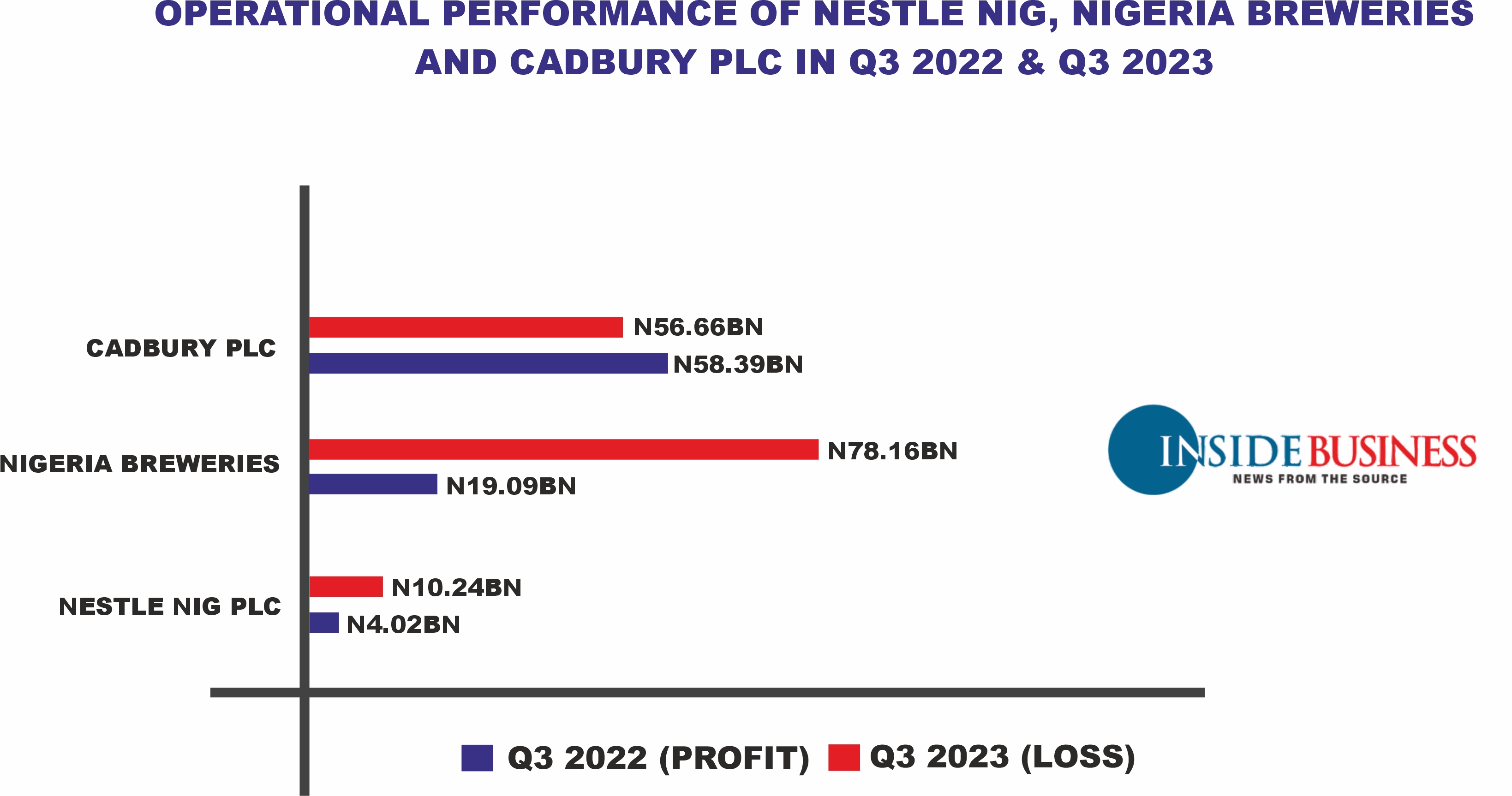

From a total profit of N81.5 billion in the third quarter of 2022, three multinational companies, Nestle Nigeria Plc, Nigerian Breweries Plc, and Cadbury Nigeria Plc have declared a N145 billion loss in the third quarter (Q3) of 2023, demonstrating the current economic realities in the country.

The poor performance by these three companies is coming on the backdrop of naira devaluation and high cost of operation.

The Central Bank of Nigeria (CBN) recently announced changes to the operations in the Nigerian Foreign Exchange (FX) Market, including the abolishment of segmentation, with all segments now collapsing into the Investors and Exporters (I&E) window and the reintroduction of the ‘Willing Buyer, Willing Seller’ model at the I&E window.

Since then, the local currency has depreciated significantly, leading to a high cost of goods and services.

The breakdown revealed that Nigerian Breweries declared N78.16billion loss before tax in Q3 2023 from N19.09billion profit before tax in Q3 2022, while Nestle Nigeria reported N56.66billion loss before tax in Q3 2023 from N58.39billion profit before tax in Q3 2022.

In addition, Cadbury Nigeria declared N10.24 billion loss in Q3 2023 from N4.02 billion profit before tax in Q3 2022.

InsidebusinessNG gathered that Nigerian Breweries reported N86.83 billion net loss on foreign exchange transactions in Q3 2023 from N10.36 billion in Q3 2023.

Nestle Nigeria also declared N127.46 billion net exchange loss on translation of foreign currency-denominated balances in Q3 2023 from N1.69 billion in Q3 2022, while Cadbury Nigeria reported N20.69 billion unrealized exchange difference in Q3 2023.

Nigerian Breweries in a statement said, “Overall, volumes declined in the period under review due to continued high pressure on disposable income and the socio-political challenges in various parts of the country. However, flavoured beer volumes increased led by Desperados.

“Revenue increased by a low-single-digit percentage driven by pricing to mitigate inflation. The operating profit was impacted by lower volumes, higher input costs influenced by inflation and devaluation of the naira, and a one-off restructuring cost. Pricing and significant cost savings initiatives were not enough to fully mitigate rising input costs.

“A combination of foreign exchange losses owing to the devaluation of the naira and higher interest costs resulted in a net loss during the period.”

Comments are closed.