Mixed Feelings Await Cardoso’s Maiden MPC Meeting

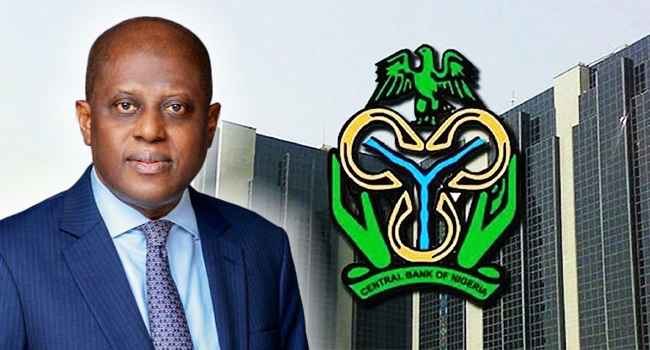

Analysts have expressed mixed monetary outcomes from the maiden Monetary Policy Committee (MPC) to be presided over by Governor Yemi Cardoso at the Central Bank of Nigeria (CBN).

The MPC meeting commenced on Monday and is expected to end on Tuesday in Abuja.

It would be recalled that at the last policy meeting of the MPC in July 2023, the anchor rate – the Monetary Policy Rate (MPR) – was raised by 25basis points to 18.75per cent, in continuation of the apex bank’s policy onslaught against Nigeria’s high inflation rate.

Nigeria’s inflation, however, has remained unresponsive to the various CBN’s strategies (up 582bps since the last MPC to 29.9per cent y/y), largely due to a lack of synergy between fiscal and monetary authorities, and the faulty lines in policy transmission mechanisms.

The currency has remained under pressure against the greenback in the foreign exchange market in 2024 after the naira was implicitly devalued for the second time in seven months by about 40 per cent at the Nigerian Autonomous Foreign Exchange Market (NAFEM) following the revision of the rate calculation methodology by the FMDQ.

Analysts at Cordros Research stated that the MPC is expected to attribute the weakness of the naira to increased speculation and money supply saturation while restating its commitment to settling all remaining backlogs, employing its policy tools to manage system liquidity whilst maintaining transparency and price discovery at the NAFEM market in a bid to stabilise the exchange rate against the greenback.

According to them, “We anticipate a decisively hawkish stance from the MPC regarding interest rates, aligning with the CBN’s commitment to achieving price stability.

“Our projection is for a significant increase in the monetary policy rate by 150 basis points while leaving other parameters constant. The anticipated increase in the policy rate would be in contrast to the prevailing global trend, where many central banks are scaling back on rate hikes and contemplating reductions.

“We expect the MPC’s decision to be primarily influenced by the soaring inflation, which rose to a multi-decade high of 29.90 per cent, and the depreciation of the currency.”

Analysts at Afrinvest Research anticipated the MPC might further tighten the anchor rate by 100 – 200baasis to 19.5per cent – 20.5per cent, premised on stubborn domestic inflation, the reluctance of global systemic central banks to cut rates, and the positive but modest domestic GDP growth numbers for 2023.

They added that “we canvass that the monetary authority should also consider stemming the growth of money supply in the financial system as broad money supply surged 76.4 per cent y/y to an all-time high of N93.7 trillion as of January 2024.

“The alarming growth in money supply might be detrimental to the efforts of the Apex Bank to stem the runaway inflation rate. In all, we do not see the MPC keeping rates constant, given the need to incentivise liquidity mop-up to tame inflation. Hence, a “HOLD’ stance is highly unlikely.”

Comments are closed.