CBN Clears $7bn FX Backlog As Naira Appreciates To N1,492.6/$

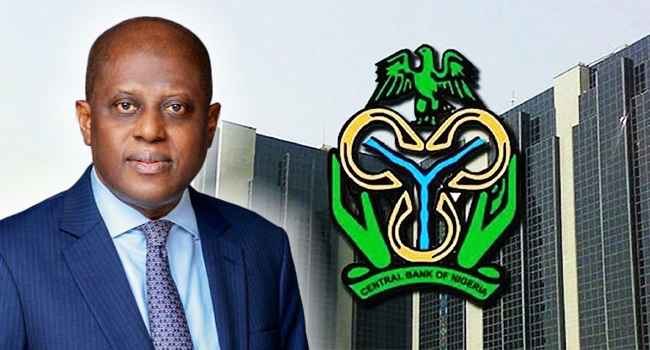

The Central Bank of Nigeria (CBN) on Wednesday said it has cleared the $7 billion foreign exchange (FX) backlog inherited by Governor Yemi Cardoso.

This move fulfills a key pledge on his appointment and signifies a significant step towards restoring confidence in the economy.

Amid the settlement, the Naira appreciated by 4.35 percent to close at N1,492.61 against the dollar.

In a statement on Wednesday, CBN’s Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali, confirmed the settlement of all valid FX backlog claims.

The CBN, she said, employed Deloitte Consulting, an independent auditing firm, to meticulously assess the transactions, ensuring that only legitimate claims were honoured.

“Any invalid transactions were referred to the relevant authorities for further investigation,” she stated.

The CBN’s commitment to tackling the FX backlog appears to be paying off.

The Governor of the CBN, Mr. Olayemi Cardoso, assured foreign investors that the remaining five foreign exchange (FX) backlogs will be cleared in the days ahead.

Cardoso said, “Basically, what we have done with those is that we have paid as much as we can to the point where we have cleared the backlog of all the banks save five. All the banks’ genuine and verifiable backlogs have been cleared, save five.

“We are confident that we will shortly be in a position where the whole issue of forwards would be behind us. I would say in the next few days we should be in a position where the balance of the five would have been put behind us.

“I have tried as much as possible to be consistent on this matter. I don’t make promises I don’t fulfil. The last time I spoke on this matter, I was confident that within one month, we would be more or less out of it and I’m saying again that right now, I think in the course of the next few days, maybe a week and a half, this should be put behind us.”

The apex bank governor also revealed that Nigeria had attracted $2 billion in foreign portfolio inflows this year.

According to him, “Last year, the total amount of inflow to the best of my knowledge from FPI was down to $ 3 billion. Already this year alone from the little we have done, we have attracted $ 2 billion.

“My point is this, with the right policies, approach, and open and transparent mechanism flow will start coming.

“We have done as much as possible to move the market to a more transparent and open market such that those who play in it can get the confidence that arguably lost over a period of time.”

Comments are closed.